Contact Us

Cell Phone: 314-740-2989

Email: aksmith@gmail.com

Hours

- Mon - Fri

- -

- Sat - Sun

- -

24 Hour Call Availability

CALL NOW 24/7 Availability: 314-740-2989

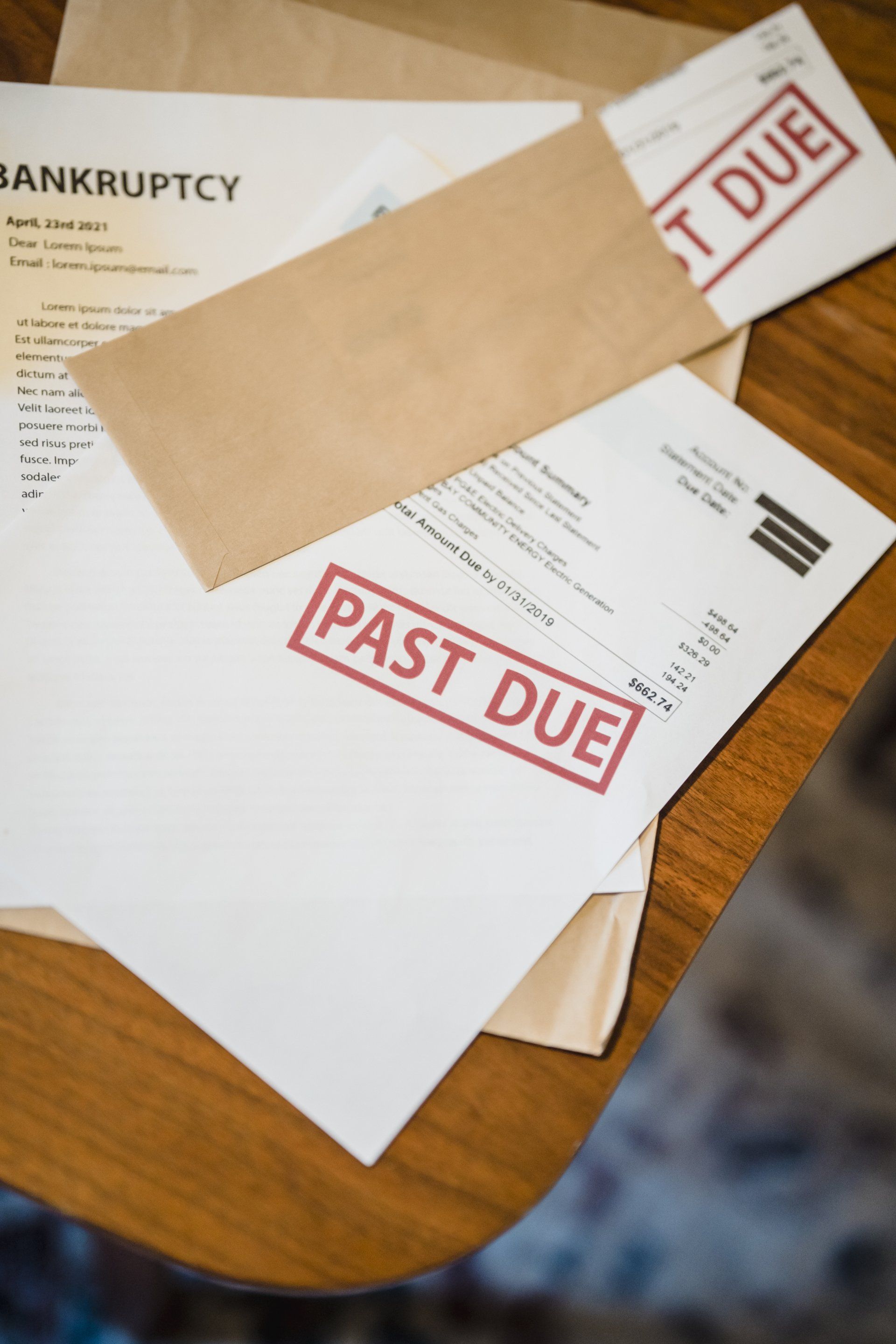

Ask a St. Louis Bankruptcy Lawyer: What to Expect During the Bankruptcy Process

Many people who are considering bankruptcy are confused or even anxious about what the process entails. Thankfully, a St. Louis bankruptcy lawyer can guide you through the process. The first thing to do would be to find out if you are eligible to file for Chapter 7 or 13.

If you are truly considering filing Chapter 7 or 13, then you need to start looking at which route to take. Once you know that bankruptcy will be an option, you need to complete a pre-filing financial management class. That being said, here is a list of approved pre-bankruptcy counseling services.

Next, a client will take what is called a “means test”. According to Investopedia, a means test is used to determine whether you qualify for a Chapter 7 bankruptcy based on your income. The means test averages your past six months of income. The means test also plays a roll in a potential Chapter 13 bankruptcy as well.

There are a few exceptions of income that is not included in the means test. For example, if you receive VA disability benefits or receive social security benefits, this would not be included in the means test. The amount of consumer debt you have also determines if you have to take this test. For example, if the majority of your debt is non-consumer debt (ie- business debt), then the means test is not necessary.

Also, if you are living beneath the Missouri Median Income level, then you won’t have to take the test. To determine this, take your monthly wages over the past six months and average them. Then, count how many people are in your household, and refer to this chart under “Missouri Median Income” to see your numbers.

Next, your forms will need to be submitted to the courts, which I will take care of as your St. Louis bankruptcy lawyer. You’ll then be assigned a trustee, and shortly after that there will be a meeting with your creditors where you’ll be asked about the state of your finances as well as the information you put on your court forms.

Contact Your Trusted St. Louis Bankruptcy Lawyer

My goal is to help to make your financial future as bright as can be, and the first step is to contact me here at my offices. You can do so easily by calling me directly at AKS Law by dialing 314-740-2989.

Schedule a Case Evaluation

Contact us now!

Homepage FCE Form

We will get back to you as soon as possible.

Please try again later.

By submitting this form, you agree to be contacted by our law firm, either by phone, text or by email.

Office Hours

- Mon - Fri

- -

- Sat - Sun

- -

Phone Answered 24/7

Contact Information

Cell Phone: 314-740-2989

Email: aksmithlaw@gmail.com

Fax: 314-781-2695

Disclaimer: The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information is not intended to create, and receipt or viewing does not constitute an attorney-client relationship.

All Rights Reserved | AKS Law | Powered By Convert It Marketing | Privacy Policy

All Rights Reserved | AKS Law | Powered By Convert It Marketing | Privacy Policy